Give your money wings

Add funds to your Aeldra account* and then let us do the magic.

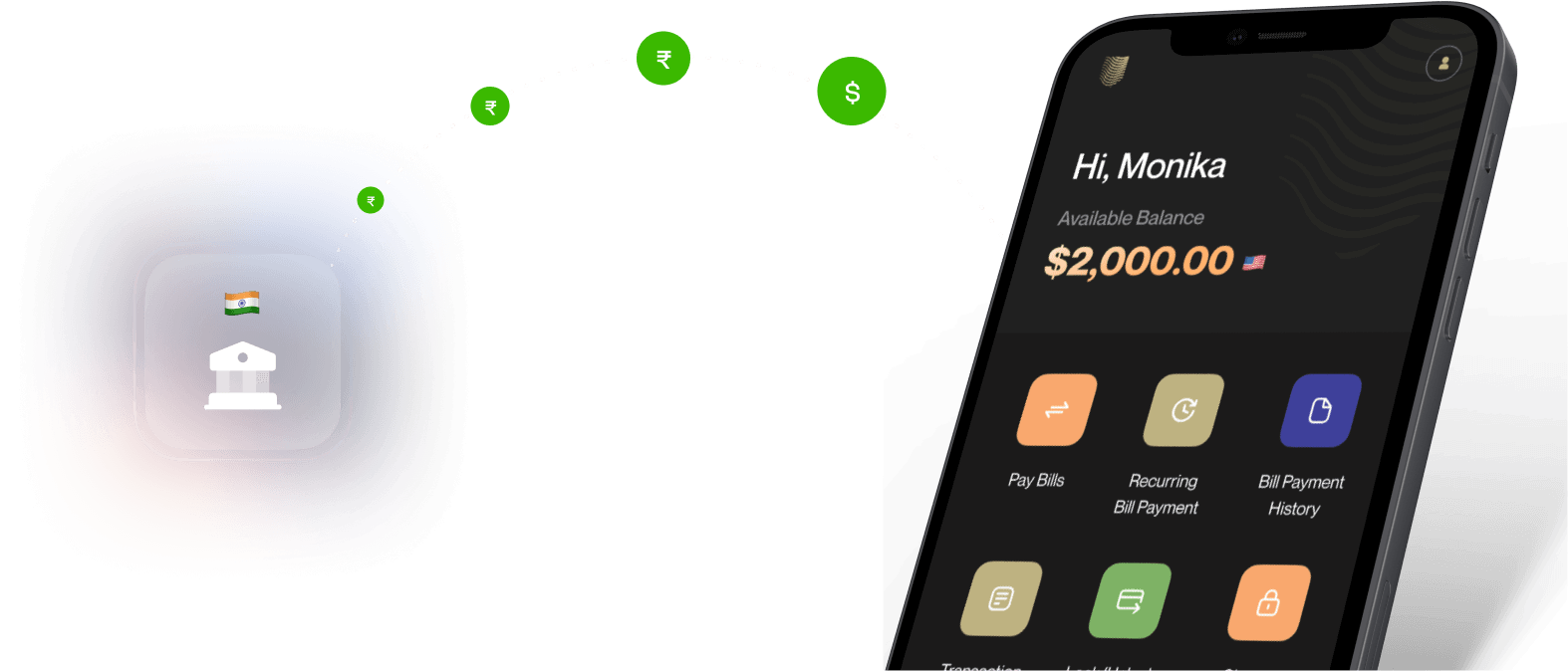

Fund using an Indian Bank account

Use these instructions if your transferring money from the bank you're banking* with in India to your Aeldra account*.

Supported Banks

The following banks have been tested for transfers. Just click on the your bank’s logo and follow the instructions.

HDFC Bank

Download PDFICICI Bank

Download PDFAxis Bank

Download PDFSBI

Download PDFIDFC First Bank

Download PDFAny Other Bank

Download PDFFor U.S. Bank A/C - How it works?

Follow these instructions if you're transferring money from another U.S. Bank account* to your Aeldra account*.

We're all ears.

There's no such thing as a stupid question.

Aeldra is a digital banking* and investment platform serving students, professionals, and investors globally. Aeldra offers an FDIC-Insured* U.S. bank account* with a Mastercard^ for U.S. residents, through our banking* partner Blue Ridge Bank, N.A., and will soon offer a U.S. brokerage account*, no-FICO credit card, and no-FICO mortgage (home loan). Aeldra's mission is to drive global access to financial services in a safe and compliant way leveraging the latest technologies.

The Company is headquartered in Silicon Valley and founded by CXO-level executives from Goldman Sachs, McKinsey, Cargill, Accenture, and Infosys. Aeldra has launched in the U.S. and India in Q1 2021, with a U.S. bank account*. The Company will offer a brokerage account* to existing Aeldra customers in Q4 2021, and will soon expand to other geographies.

U.S. residents or Indian citizens can download the Aeldra App and apply for an account* digitally from anywhere in the world without the need to visit a branch or provide a physical document. In line with Aeldra's mission to make it easy for customers with a legitimate need for a U.S. bank account*, Indian citizens do not require a U.S. Social Security Number (SSN) to open an account* if they have an Indian passport. Account* opening is subject to Aeldra's KYC and AML policies in line with U.S. government regulations. Through proprietary algorithms, processes, and technologies Aeldra has digitized the KYC process. However, a small portion of applicants may require manual review. Applicants with U.S. banking* needs for employment, educational, investment, or other purposes can open a U.S. bank account* and fund it even from outside the U.S.

The founders of Aeldra come from a conservative banking* background and, unlike many other FinTech's, risk management and compliance are in the Company's DNA. Aeldra is compliant with U.S. regulations and Government of India regulations. For instance, transfer of money from India to the Aeldra account* will need to be done under the RBI's Liberalized Remittance Scheme. Aeldra offers banking* services through a partnership with regulated financial institutions in the U.S. including Mastercard^ and Blue Ridge Bank, N.A.

Your money with Aeldra is insured by the Federal Deposit Insurance Corporation, through Blue Ridge Bank N.A., Member FDIC, just as it would be for any large U.S. bank like JPMorgan Chase or Citibank. The FDIC - short for Federal Deposit Insurance Corporation - is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC-Insured* bank fails. It is backed by the full faith and credit of the United States government. The FDIC-Insurance* is through Blue Ridge Bank, N.A., a nationally chartered U.S. bank. Since the FDIC began in 1934, no depositor has ever lost a penny of FDIC-Insured* funds. FDIC insurance covers funds in deposit accounts up to $250,000 per depositor. This means that even in the unlikely event that Aeldra shuts down or Blue Ridge Bank shuts down, you can access and withdraw your funds. For more details click here: FDIC.

Debit cards^ issued to customers will be restricted from usage until the customer is physically in the U.S. Customers will have to provide documentation by contacting Aeldra Concierge that establishes proof of U.S. entry or U.S. presence to remove the usage restriction. Mastercard^ debit cards^ are currently available to U.S. resident customers with a U.S. mailing address by calling Aeldra Concierge at U.S. Toll-free Number: +1 844 333 3101. Cards^ ship the next business day by US Postal Service First Class Mail.

For your convenience, you can download and refer to detailed step-wise screenshots of the Wise transfer process here.

DOWNLOAD FILEAccount* to Account* Transfer (ACH, Wire)

To move money to the Aeldra account*, use the online or mobile banking* of the bank the money is being transferred from. After logging into the account*, initiate the transfer to Aeldra using the Routing Number and bank details below.

INSTRUCTIONS

Your Aeldra Account* Number^^

Bank ABA / Routing number: 053112929

Recipient Bank Name: Blue Ridge Bank, N.A.

Bank Address: 17 W Main St, Luray, VA 22835, U.S.A.

^^Your Aeldra Account* Number can be viewed in-app on the home screen by clicking on "View All" to the right of "Recent Transactions".

![[object Object]](/img/step-from-india-1.png)

![[object Object]](/img/step-from-india-2.png)

![[object Object]](/img/step-from-india-3.png)

![[object Object]](/img/step-from-india-4.png)

![[object Object]](/img/step-from-india-5.png)

![[object Object]](/img/ach-transfer.png)

![[object Object]](/img/ach-transfer-1.png)

![[object Object]](/img/ach-transfer-2.png)

![[object Object]](/img/ach-transfer-setup.png)

![[object Object]](/img/ach-transfer-setup-1.png)

![[object Object]](/img/ach-transfer-setup-2.png)

![[object Object]](/img/ach-transfer-setup-3.png)

![[object Object]](/img/wire-transfer.png)