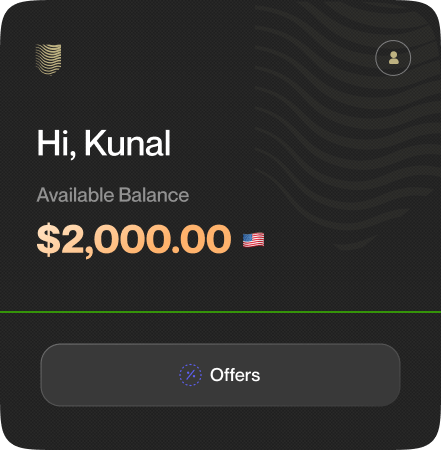

“For long, I have been encouraging friends, family and clients to diversify their investments and invest in the U.S. Doing so without a bank account* is often daunting. Aeldra allows me to open a U.S. bank account* remotely from India. The process is quite easy and hassle-free”

Amit Wilson

Entrepreneur and Investment Professional

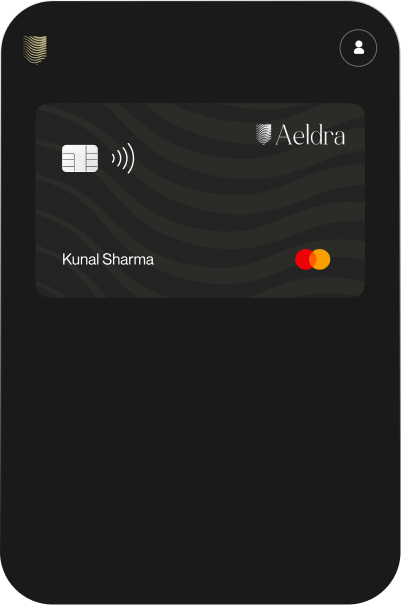

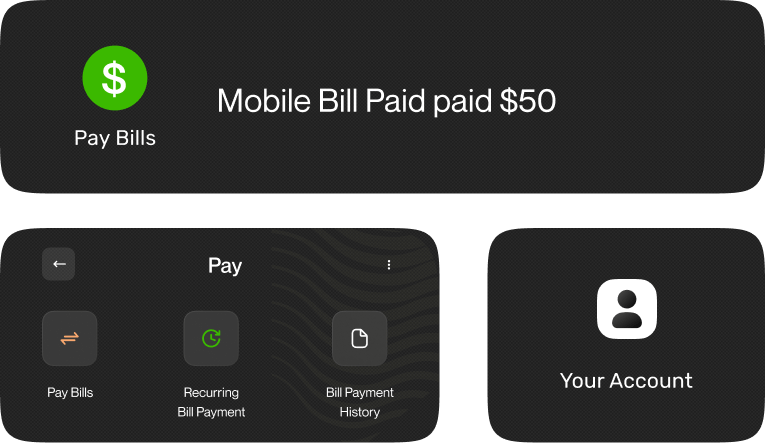

“Aeldra fulfills a very vital gap for frequent global business travelers like myself. This account* with debit card makes it not only very convenient to use during my travels in the U.S. but also helps me save a lot in forex and other bank charges.”

Neeraj Sinha

IT professional & Frequent Business Traveller

“Aeldra's on-boarding experience is truly one-of-a-kind and very intuitive. I was able to open an account* using my mobile in a few simple steps, within a few minutes and even get my debit card instantly.”

Satish Dasam

Business Executive and Technology Leader

“Aeldra's ability to open accounts with only Indian passport is a great boon for students like me going to the US. Now I can easily get living expenses credited into my bank account* without having to go through the University.”

Lakshya A

Aspiring Student for advanced studies in US